Average tax withheld from paycheck

When to Check Your Withholding. The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4.

Payroll Tax What It Is How To Calculate It Bench Accounting

Oregons statewide transit tax is one-tenth of one percent 001.

. The wage bracket method and the percentage method. For a single filer the first 9875 you earn is taxed at 10. The average tax wedge in the US.

New job or other paid work. Only the very last 1475 you earned. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. FICA taxes consist of Social Security and Medicare taxes. You pay the tax on only the first 147000 of your.

124 to cover Social Security and 29 to cover Medicare. The amount of taxes that your employer withholds depends on your filing status the amount of. When you have a major life change.

Paycheck Deductions for 1000 Paycheck. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. For 2022 employees will pay 62 in Social Security on the.

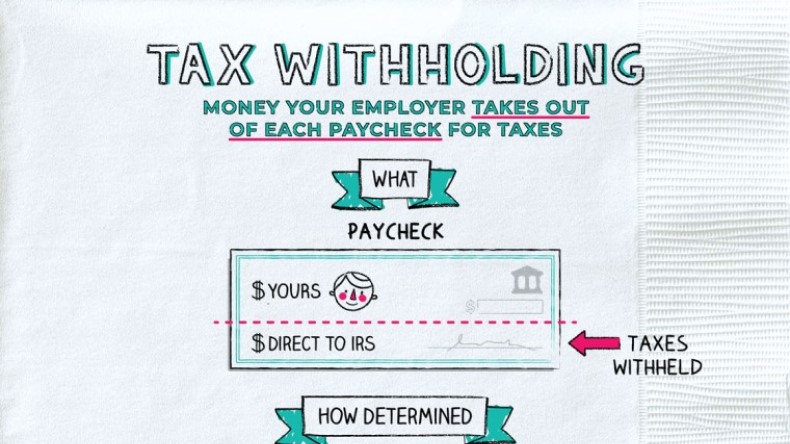

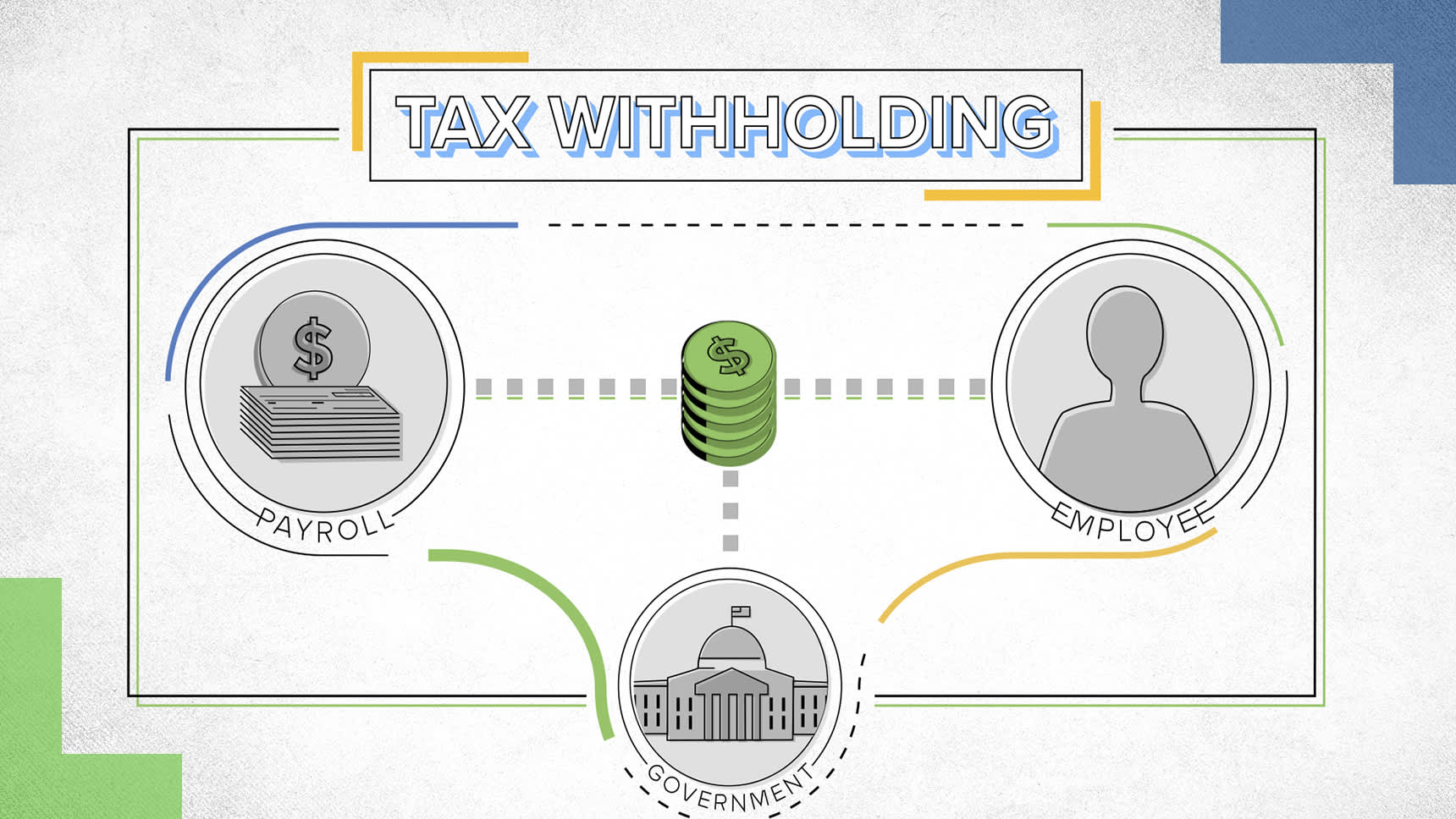

In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability. For employees withholding is the amount of federal income tax withheld from your paycheck. Income tax returns must be filed every spring but income taxes are also paid all year round.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Social Security has a wage base limit which for 2022 is. This total represents approximately how much total federal tax will be withheld from your paycheck for the year.

The remaining amount is 68076. There are two main methods small businesses can use to calculate federal withholding tax. This 153 federal tax is made up of two parts.

This is done by authorizing employers to withhold money from employees paychecks to put toward. How much tax is deducted from a 1000 paycheck. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly.

Was about 346 for a. The amount of income tax your employer withholds from your regular pay. These amounts are paid by both employees and employers.

In addition to this most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks. Each pay period your employer withholds a part of your wages to cover your income tax bill. You find that this amount of 2025 falls in.

Oregon employees will see a new tax withholding on paystubs received after July 1. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. Your employer pays an additional 145 the employer part of the Medicare tax.

This year you expect to receive a refund of all. From The State of Oregon. Check your tax withholding every year especially.

There is a set percentage however for Social security 62 and Medicare 145 Federal. If you think too much or too little money is being withheld from your paycheck you can file a fresh W-4 with your employer at any time during the year. The IRS made notable updates to the.

When you do this be sure to indicate how. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. There is no set percentage of tax withhled for federal income tax withholding.

How To Calculate Payroll Taxes For Your Small Business

Check Your Paycheck News Congressman Daniel Webster

What Are Marriage Penalties And Bonuses Tax Policy Center

Different Types Of Payroll Deductions Gusto

Tax Withholding For Pensions And Social Security Sensible Money

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2022 Income Tax Withholding Tables Changes Examples

Payroll Tax Vs Income Tax What S The Difference

What Is Tax Withholding All Your Questions Answered By Napkin Finance

2022 Federal State Payroll Tax Rates For Employers

What Is Tax Withholding All Your Questions Answered By Napkin Finance

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

Understanding Your W 2 Controller S Office

How To Calculate Payroll Taxes For Your Small Business

Calculating Federal Income Tax Withholding Youtube